Strategic Wealth Safeguarding for the Generations Ahead

Many people delay planning, yet life rarely warns clearly. Sudden events freeze assets instantly, and therefore families struggle. Proper structures protect wealth and intentions. Trust planning offers calm, predictable security.

Many say later is fine, yet life rarely gives warning. Unexpected issues freeze assets quickly, and therefore families face stress. “Global Asset Trustee (M) Berhad services” with trust planning creates stability during uncertain moments. Every structure strengthens security and purpose.

Quick Look

Problem 1: “Global Asset Trustee (M) Berhad services” Assets Easily Get Exposed

Solution: Private Trust|A Shield That Removes Personal Risk

Assets held under a person’s name become exposed to lawsuits, debts, and marital disputes, and one event can freeze everything. A private trust moves assets out of personal ownership and legally separates your wealth from personal risk. Cash flow remains flexible while long-term safety increases, and GAT enforces your instructions precisely to create predictable protection.

Problem 2: “Global Asset Trustee (M) Berhad services” Families Lose Support After Unexpected Events

Solution: Family Trust|Ensures Care Continues Without Disruption

If something happens to the breadwinner, financial support can stop instantly and families begin to struggle within weeks. A family trust activates quickly, with distribution starting within 15 working days so education, living costs, and medical needs continue smoothly. The structure feels logical yet holds deep emotional meaning because care never stops, even when someone is gone.

Problem 3:”Global Asset Trustee (M) Berhad services” Insurance Money Often Gets Mismanaged

Solution: Insurance Trust|Turns a Payout Into Long-Term Protection

Large insurance payouts are often spent too quickly or misused, causing families to lose the long-term support the policy was meant to provide. An insurance trust directs every dollar with intention, allocating funds to education, medical care, or living support, and payouts may follow planned stages that prevent misuse. Parents often say this structure finally protects the money as intended.

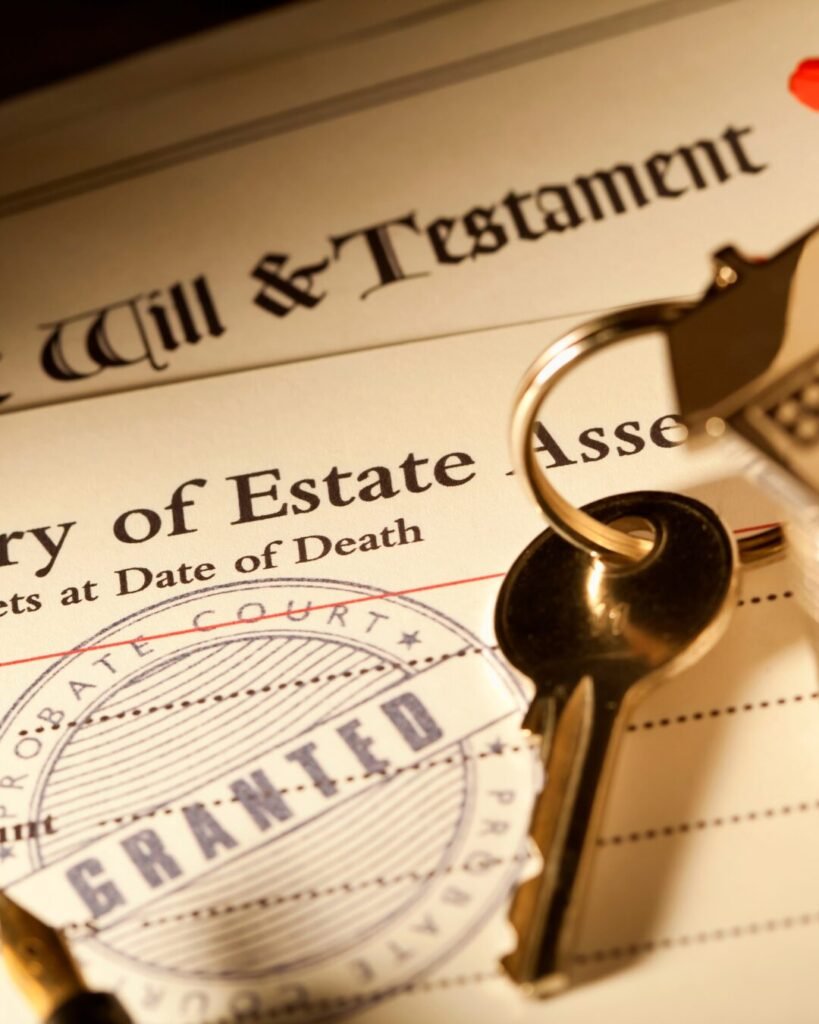

Problem 4: Property Causes Delays and Disputes

Solution: Real Estate Trust|Removes Burden From Property Ownership

Property transfer becomes slow, complex, and often triggers family conflict, and probate delays can take months or even years. A real estate trust places property within a clear legal structure that avoids probate entirely, making transfers efficient and transparent. Families avoid disputes, and homes remain stable, valuable assets.

Problem 5: Businesses Collapse Without a Succession Plan

Solution: Corporate Trust|Protects Stability Beyond the Founder

When a business owner passes away, shares may fragment, operations may break, leadership may stall, and companies may lose direction. A corporate trust secures governance and shares under one structure, preventing fragmentation and protecting decision-making. Many businesses remain stable not because of luck, but because trust planning created continuity.

Problem 6: People Want Legacy, but Lack a Structure

Solution: Charitable Trust|Ensures Wealth Creates Real, Lasting Impact

Many people want to leave meaningful impact, yet informal giving lacks direction and longevity, causing money to lose effectiveness. A charitable trust supports long-term giving missions by funding education, environmental initiatives, and social needs with legal safeguards. GAT provides a framework that maintains purpose and compliance, allowing values to continue quietly yet powerfully.

Problem 7: Families Fight When Instructions Are Unclear

Solution: Will Writing|Clear Instructions Prevent Conflict

Without a clear will, families face confusion, disputes, and legal complications, and guardianship and distribution decisions often become emotional battles. A well-written will removes uncertainty, and when aligned with trust planning, everything becomes consistent with no gaps or contradictions. Clarity becomes a final gift to the family.

Problem 8: Families Are Overwhelmed After Death

Solution: Estate Administration|Professional Support During Hardest Moments

After a death, families must handle legal paperwork, debt settlement, asset transfers, and government procedures, creating a heavy burden during grief. Estate administration services manage the entire process professionally, making legal tasks organised and efficient. Families can grieve without administrative pressure, and support becomes practical and deeply meaningful.

Final Problem: Wealth Is Built, but Not Protected

Solution: Structured Trust Planning|A System That Protects What Matters

Wealth is not a finish line; it is a journey that requires protection, direction, and structure. Trusts safeguard assets, relationships, and meaning. With the right planning, uncertainty becomes stability, and when the future feels unpredictable, preparation becomes love.

Wealth requires protection, and structure provides stability. Trusts guide assets safely and strengthen family security. With proper planning, uncertainty becomes manageable, and preparation becomes love.

Website: Global Asset Trustee (M) Berhad

Email: admin@globalassettrustee.com.my

Contact Number: 03-9771 5159

Address: A-13-4, Block A, Northpoint, 1, Medan Syed Putra Utara, Mid Valley City, 59200 Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur

Frequently Asked Questions — Advanced Trust Topics

Further insights for individuals seeking deeper understanding of trust planning

1) Can a trust be changed after it is set up?

Yes, depending on the type of trust. A revocable trust allows the settlor to modify or update terms during their lifetime. An irrevocable trust generally cannot be changed once established, as the assets are legally transferred out of the settlor’s ownership. Each structure offers different levels of flexibility and protection.

2) Who can be the beneficiaries of a trust?

Beneficiaries can include family members, children, spouses, business partners, or even charitable organisations. In some cases, trusts are created to support individuals with special needs, manage education plans, or provide structured financial support for multiple generations.

3) What happens to a trust if the trustee passes away?

If the trustee passes away or is unable to perform their duties, a successor trustee—appointed in the trust deed—will take over. This ensures continuity and avoids disruption. Licensed trust companies provide additional stability because they operate as institutions rather than individuals, reducing the risk of interruption.

4) Are trust assets considered part of the estate for probate?

No. Assets that are legally transferred into a trust are no longer part of an individual’s personal estate and therefore do not go through probate. This allows faster access for beneficiaries and avoids delays commonly associated with court-supervised estate administration.

5) Can a trust hold property located outside Malaysia?

Yes, depending on the trust’s structure and the legal requirements of the foreign jurisdiction. Many individuals use trust planning to consolidate local and overseas properties under