Building a Stable and Independent Asset Structure

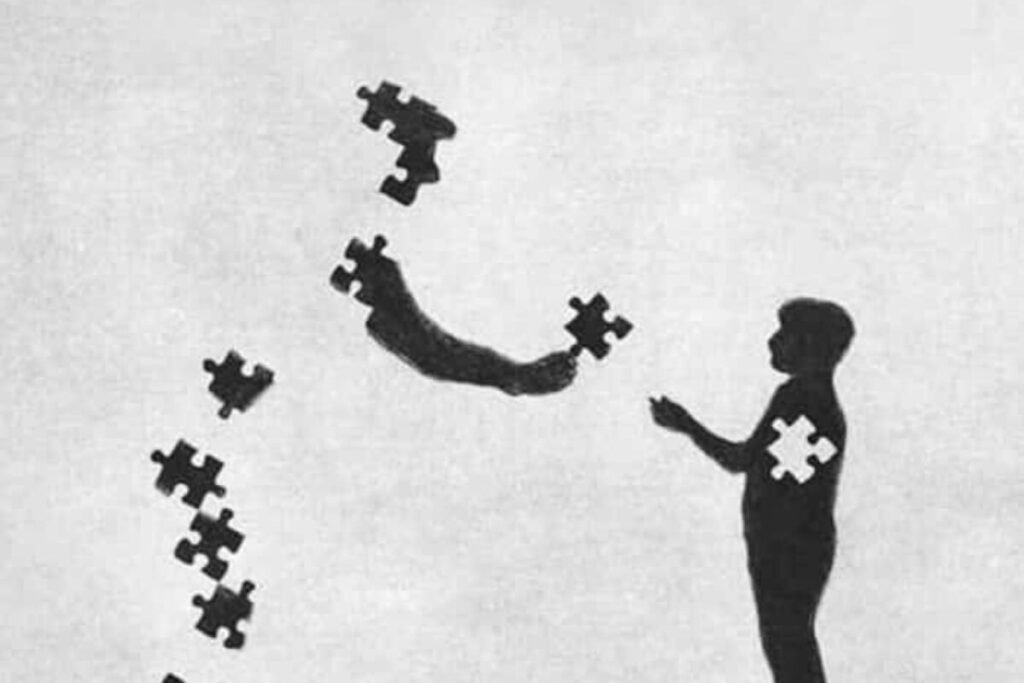

GAT Importance lies in its ability to create an independent, transparent, and risk-isolated structure for family and business assets, ensuring stable and continuous execution across unpredictable conditions.

As modern families and businesses face increasing uncertainty—from emotional conflicts to legal disputes, sudden health events, and commercial liabilities—the need for stable, predictable asset governance has never been greater. Importance of GAT emerges precisely from this context: it introduces an impartial, rule-based framework that shields assets from human error, emotional tension, and external volatility. Unlike traditional asset handling, which often relies on subjective decisions, GAT ensures consistency, independence, and long-term continuity through institutional execution.

Importance of GAT: Ensuring Objective, Consistent, and Rule-Based Asset Execution

Without structure, asset decisions tend to fluctuate depending on relationships, emotions, or unexpected events. GAT solves this by replacing subjectivity with formalized, documented, and enforceable rules.

Below is how GAT strengthens asset execution:

| Traditional Weakness | Improvement with GAT |

|---|---|

| Asset use shifts based on emotions | GAT enforces stable rule-based decisions |

| Family members interpret decisions differently | Clear preset instructions prevent disagreement |

| No consistency during emergencies | GAT provides automatic, uninterrupted execution |

Importance of GAT: Providing Strong Risk Separation Across Life, Family, and Business

Risk separation is one of the most critical benefits of GAT. Modern families often experience asset entanglement—family money mixed with business funds, care budgets affected by inheritance fights, or personal liabilities spilling over into household assets.

GAT prevents all of that.

Key advantages:

- Family wealth is completely insulated from business debt or litigation

- Business operations remain unaffected by inheritance disputes

- Care funds continue without being frozen by legal processes

- Personal lawsuits cannot access GAT-protected assets

| Risk Source | GAT Separation Method |

|---|---|

| Family conflict | Assets follow contractual rules, not emotions |

| Business downturn | Institutional layering prevents cross-contamination |

| Personal lawsuits | GAT assets remain shielded and untouched |

Ensuring Continuity of Care, Support Funds, and Long-Term Planning

For young children, elderly parents, and vulnerable family members, stability of care is essential. GAT guarantees uninterrupted execution of support funds even when unexpected events occur.

Benefits include:

- Automatic, scheduled releases for caregiving needs

- Zero delays caused by family disagreements

- Clear records ensuring funds are not diverted

- Long-term protection for dependents

Life events—incapacity, illness, conflict, or death—can immediately disrupt financial access. GAT eliminates these disruptions. Once care instructions are written into the structure, the system executes them regardless of who is arguing, who is available, or who is in charge. This provides ongoing security for dependents and ensures the family’s well-being is never interrupted.

Enhancing Multi-Generational Legacy, Governance, and Execution Efficiency

Traditional inheritance processes often face delays, conflicts, unclear instructions, or misinterpretations. GAT removes these uncertainties through a structured, impartial mechanism.

Strengths:

- Less interpretation = fewer arguments

- Faster execution compared to traditional wills

- Stable guidance across multiple generations

- Long-term clarity for family governance

A legacy plan is only as strong as its ability to withstand disagreements. GAT turns subjective decisions into objective process flows. No relative has the authority to alter outcomes. This brings fairness, transparency, and long-term stability—especially important for families with complex relationships or combined business interests.

Ultimately, GAT lies in its ability to offer reliability when everything else becomes uncertain. Through institutional execution, risk isolation, and long-term continuity, GAT creates a protective ecosystem for both family and business assets. It is not merely a tool for the wealthy—it is a structural necessity for any family seeking order, safety, and sustainable governance.

Website: Global Asset Trustee (M) Berhad

Email: admin@globalassettrustee.com.my

Contact Number: 03-9771 5159

Address: A-13-4, Block A, Northpoint, 1, Medan Syed Putra Utara, Mid Valley City, 59200 Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur

FAQs — Practical Uses of GAT

For families and business owners seeking asset stability and risk separation

1) How does GAT maintain stability during family disputes?

GAT enforces rule-based execution, preventing emotional influence or family tension from disrupting asset plans.

2) Can GAT protect family assets from business dangers?

Yes. Layered structures ensure that business risks do not spill over into family wealth or personal funds.

3) Does GAT guarantee uninterrupted care funding?

Yes. Care and support payments follow predefined instructions and do not depend on family consensus or legal timing.

4) How does GAT reduce inheritance disputes?

Institutional execution removes personal discretion, eliminating ambiguity and minimizing conflict among heirs.

5) Is GAT suitable for small or medium estates?

Yes. GAT’s protective value lies in structure and stability, not in the amount of wealth.