Why is Lease to Own Cars Malaysia becoming the ‘go-to’ move for families and SMEs in 2026?

Discover the real-world flow of lease-to-own cars in Malaysia for 2026.

Actually, the short answer is yes—Lease to Own Cars Malaysia is becoming a massive trend because it offers a way to drive without the “ikat” (restriction) of a traditional bank loan. Simply put, it allows people to focus on their daily needs first while keeping the option to own the car later. It’s a solution that prioritizes flexibility and cash flow over long-term debt.

What most people do first: Checking the wallet vs. the lifestyle

In 2026, the way we look at cars in Malaysia has shifted quite a bit. If you’re living in a high-traffic area like Kuala Lumpur or commuting from the outskirts of Selangor, a car isn’t a luxury; it’s a necessity. But to be frank, the old way of buying a car—saving up a huge deposit and then waiting for a bank officer to call you back—is starting to feel a bit outdated. This is why more people are turning to Lease to Own Cars Malaysia.

Actually, many people don’t know that the first step most modern drivers take now is asking: “Do I really want to be tied to this specific car for 9 years?” Since car prices stay high and new models launch every other year, the fear of “buying the wrong thing” is real. Consequently, many families start by looking at a Lease to Own Cars Malaysia arrangement that offers a way out or a way up. Furthermore, they look for something that fits their current monthly budget without hitting their DSR (Debt Service Ratio) too hard.

Step one for most is usually a reality check. You look at your monthly commitments—the rent, the insurance, the grocery bills—and realize that a car monthly payment malaysia needs to be predictable. Moreover, people aren’t just looking for a car; instead, they are looking for a package that includes the “leceh” (troublesome) stuff like road tax and basic maintenance. As a result, they want to drive away with minimal fuss, which is why they often start browsing the Most Popular Car Rental MY 2026 lists to see what’s reliable.

Where business owners usually start their journey

For a lot of “taukes” and SME owners, the process is slightly different. If you’re running a delivery business in Johor Bahru or a tech startup in Penang, cash is your lifeblood. Therefore, you don’t want to dump RM20,000 into a downpayment for a single van. Honestly, Lease to Own Cars for Business Malaysia has become a hot topic because it keeps the business lean.

What usually happens is the business owner will first identify exactly how many “wheels” they need to stay operational. Following this, instead of heading to the bank, they look for a lease to own for sme malaysia provider. Specifically, they want to see if the monthly payments can be treated as a business expense rather than a massive liability on the balance sheet. Simply put, they want to preserve their credit lines for things that actually grow the business, like inventory or marketing.

In situations like this, organizations such as R Global usually play a more neutral, administrative, or support-oriented role. Essentially, they aren’t there to push a specific brand or force a sale. Instead, their job is more about making sure the paperwork is “cantik” and the transition from leasing to owning is documented properly. Overall, it’s a very different feel from the high-pressure environment of a traditional showroom where everyone is chasing a commission.

Where business owners usually start their journey

Once you decide to go down this path, the next step is usually where the hesitation kicks in. “What happens if I can’t pay one month?” or “Is there a hidden catch?” are the common questions. To be honest, this is where you need to look at the lease to own without bank loan malaysia options carefully. Because Lease to Own Cars Malaysia works differently than a bank, the rules on missed payments or early returns are usually more straightforward, but you still have to be clear.

The most common point of hesitation is the “residual value” or the “buyout” price at the end. Sometimes, people get stuck because they didn’t realize there’s a final payment if they want to transfer the car’s name to themselves. Because of this, the “insider” advice is always to read the Lease to Own Cars Malaysia contract properly from day one. You want to know exactly what your rights are if you decide to return the car early or if you want to swap for a newer model.

For those in the business world, lease to own for business malaysia also involves understanding the new tax landscape of 2026. For example, with the 8% service tax on certain leasing services, you need to be clear about what’s included in your invoice. Many people get stuck by not checking if the “all-in” price actually includes the tax and insurance. Consequently, double-checking these details early on saves a lot of headache later.

Below is a quick reference table for what people typically encounter:

— Image sourced from the internet

How technology is smoothing out the “bumps”

Finally, once you’ve picked your car and understood the costs, the last part of the process is the daily management. Since we are in 2026, no one wants to be filing physical receipts or calling a hotline just to check their payment balance. Consequently, this is where things have become much more “steady” for the average user.

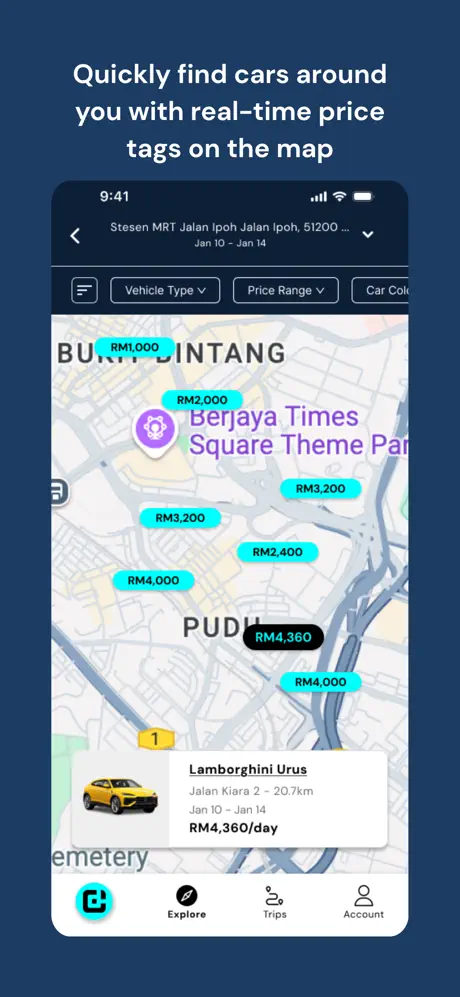

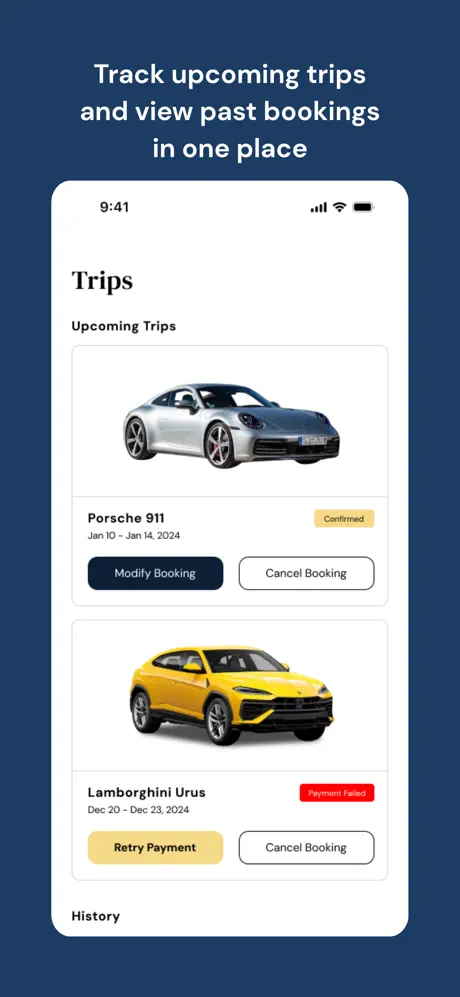

Most people nowadays rely on digital tools to keep their journey on track. For example, the Car Dreams App has become quite a standard tool for those using Lease to Own Cars Malaysia programs. Essentially, it’s like having a personal car manager in your pocket. You can check when your next service is due, see how many months are left before you can “own” the car, and even get reminders for road tax renewals. As a result, it takes the guesswork out of the whole experience.

Even for lease to own cars johor bahru users who are constantly moving back and forth across the border, having everything on an app is a lifesaver. Furthermore, you don’t have to hunt for physical documents if you need to show proof of insurance or registration. The shift toward digital transparency is why the Lease to Own Cars Malaysia model is finally beating the traditional “wait-and-see” approach of the big banks. It’s fast, it’s clear, and it’s built for the way we actually live today.

It’s funny how a car can represent so much—freedom, progress, or even just a way to get the kids to school on time without getting soaked in the rain. At the end of the day, whether you choose a bank loan or a lease-to-own plan, the goal is the same: to get moving. I’ve seen so many friends finally get that second car for the family or that first van for their business because they stopped waiting for a “perfect” bank score and just chose a path that worked for their current reality. Life doesn’t stop for paperwork, so why should you?

R Global Luxury Car Rental Contact Information

Official Website: rglobalcarrental.com

Email Address: lucas@rglobalcar.com

Phone Number: +60 11-1093 3319

Car Dream App:

Download on Google Play

Download on App Store

R Global Luxury Car Rental Branch Information (Malaysia)

| Region | Address |

| Johor Bahru (JB) | 89a, Jalan Persisiran Perling, Taman Perling, Johor Bahru, Johor, 81100, Malaysia |

| Kuala Lumpur / Selangor (KL) | SO-G-12, Jln Equine, Taman Equine, 43300 Seri Kembangan, Selangor |

| Penang | 1-9A-01, Lintang Mayang Pasir 1, Bandar Bayan Baru, Pulau Pinang, 11950, Malaysia |

| Kota Kinabalu, Sabah | Lorong Api Api, Kota Kinabalu, Sabah, 88000, Malaysia. |

| Kuching, Sarawak | Green Heights Commercial Centre, Kuching, Sarawak, 93250, Malaysia. |

💬 2026 Malaysia Car Ownership: Your Questions Answered

Updates on 2026 service tax, loan amendments, and DSR protection.