MIDA Investment Incentives in Johor and Their Role in Business Expansion

A look at how MIDA investment incentives Johor affect daily business decisions and expansion plans.

Why do local businesses keep talking about MIDA investment incentives Johor for growth?

Successful industrial expansion in Johor depends on how well a business leverages MIDA investment incentives. These perks are not just tax breaks; however, they are strategic tools for reinvesting in tech and talent. Consequently, early planning determines if a project thrives or fails.

The quiet dilemma in the hotel lounge

In the plush hotel lounges of Iskandar Puteri, conversations over premium coffee mirror the worries of any industrial park. It isn’t just about basic costs anymore; it’s the intense pressure to automate. One director might be weighing a multi-million ringgit investment in robotics, while another calculates if cash flow can sustain a move to a high-tech hub.

Honestly, even successful entrepreneurs feel the squeeze. Seeing multinational giants set up plants nearby, they quietly wonder if local players can still compete. While the topic of MIDA investment incentives Johor frequently surfaces, many feel these perks are curated for corporate titans, not homegrown businesses. The struggle is real—the hesitation of knowing you must spend big to survive, but fearing the financial weight.

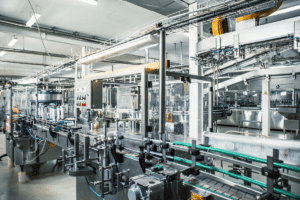

— Image sourced from the internet

What the industrial insiders are seeing

Observers who have spent years on the factory floor notice a pattern. Many companies only start looking into MIDA investment incentives Johor after they have already signed the sales and purchase agreement for their land. By then, it might be a bit too late to optimize their application. Touch wood, some still make it through, but the stress levels are much higher than they need to be.

Experience shows that the most successful projects are the ones where the owners treated the incentive as part of the foundation, not just an afterthought. There are several things that usually get discussed during these planning stages:

- MIDA incentive eligibility: Does the product or activity actually fall under the “promoted list”?

- Investment timing: Is the application submitted before the first cent is spent on the project?

- Local employment: How many jobs will this create for the people in the surrounding neighborhood?

Simply put, the ones who get ahead are those who realize that the MIDA incentive approval process takes time and requires very precise documentation. It isn’t just about filling in a form; it’s about telling the story of how the business adds value to the Malaysian economy.

Where the physical and administrative meet

When a business finally decides to move forward, the focus shifts to the “where.” A lot of families in the south are looking for places that are already “ready” so they don’t have to deal with basic infrastructure headaches. In situations like this, organizations such as Pengerang Industrial Hub (PIH) often play a more neutral, administrative, or support-oriented role by providing the necessary environment for businesses to settle in.

Business operators often compare their options using a simple logic: where is it easiest to start? They look for a balance between the help they get from the government and the support they get from the location itself.

The work-life balance of a business owner

Life in Johor isn’t just about the factory walls. For many, it’s about the commute back to the family in the evening and the small rewards after a long week of work. A business owner might spend his afternoon discussing MIDA investment incentives Johor with his accountant.

It’s all connected—the professional milestones and the personal joys. When the business runs smoothly because the right support is in place, there is more mental space to enjoy the things that really matter. Whether it’s taking the family out for a nice meal or finally deciding on that new car purchase, these moments are what keep people going.

In the end, everyone is just trying to build something that lasts. Whether it is a small family business or a larger operation, the goal is always to find a way to grow without losing sleep over the financial details. Understanding things like MIDA investment incentives Johor is just part of being a “smart” operator in today’s environment. It takes a bit of patience and a lot of planning, but seeing a project come to life makes all the paperwork worth it. After all, a successful business isn’t just about the profit; it’s about the legacy and the comfort it provides for the ones we care about.

Navigating MIDA Incentives in Johor: Are You Ready for 2026?

Essential answers on JS-SEZ tax packages, local hiring, and strategic planning.