【Breaking News】EPF Withdrawal Shake-Up 2025: Malaysia’s Latest Public Fund Reform Could Change How You Retire Forever

Uncover key updates to Malaysia’s 2025 EPF withdrawal rules, with KWSP process insights and smart retirement planning tips for a secure future.

[Kuala Lumpur – May 9, 2025 | Special Business Report]

The Employees Provident Fund (KWSP) has unveiled a sweeping reform under the EPF 2025 Policy, instantly making EPF withdrawal a national trending topic. With the changes taking social media by storm, working Malaysians are asking themselves: “Is it easier to withdraw now? Yes. But will I have anything left when I retire?”

This new wave of policy isn’t just about facilitating access to your retirement savings—it’s about reshaping the way we think about retirement planning. The shift is clear: smarter withdrawals, faster processing, stricter guidelines, and heavier personal responsibility.

In this feature, we break down the KWSP withdrawal process, highlight key points of the EPF 2025 policy, and guide you toward better, more strategic retirement planning—because withdrawing blindly may cost you more than you think.

EPF Withdrawal | From Emergency Lifeline to Strategic Tool

Traditionally, EPF withdrawals were viewed as a last resort—meant for unemployment, housing, or medical emergencies. But with the new 2025 structure, withdrawals are now also allowed for education, business, and temporary financial hardship.

Although this added flexibility seems helpful, financial experts caution that withdrawals today mean less money for tomorrow. Without deliberate retirement planning, your golden years could become a financial struggle.

KWSP Withdrawal Process 2025: Now Smarter, Simpler, and More Responsive

With the introduction of the EPF 2025 policy, KWSP’s system has undergone a major digital transformation, offering what officials claim is a “faster, smarter, safer” experience. Here’s how the updated KWSP withdrawal process works:

- Log in to the KWSP portal or MyEPF app

- Select the withdrawal category (housing, education, medical, pre-retirement, etc.)

- The system calculates your eligibility and limit

- Upload supporting documents (e.g. IC, invoices, university letters)

- AI-based screening for initial approval

- Funds are transferred to your bank account within 3–5 working days

Tip: The process may seem straightforward, but any mistakes in documentation could delay your withdrawal or cause outright rejection.

EPF Withdrawal 2025 Policy: The 3 Major Changes You Should Know Now

Our newsroom has verified with EPF insiders that the EPF 2025 policy revolves around three core goals: flexible access, stronger individual responsibility, and long-term protection. The following changes stand out:

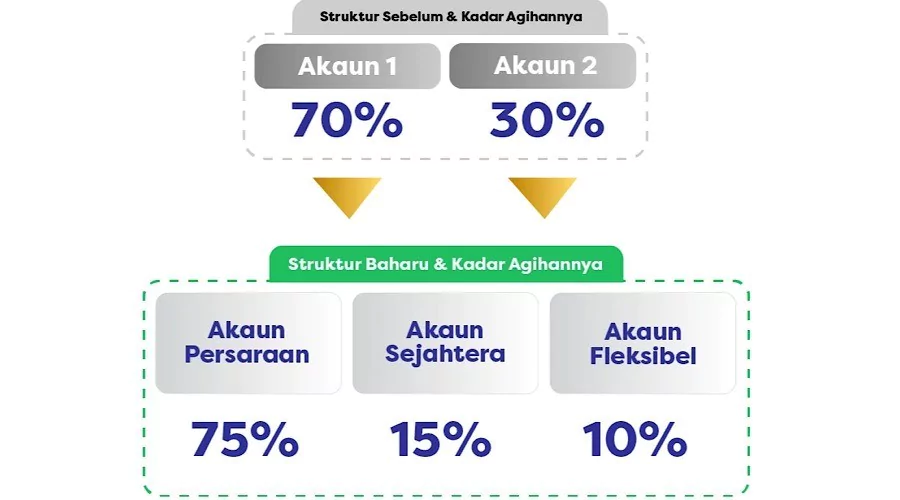

1. Account 3 Now Active for Immediate Use

A portion of your monthly contributions is now redirected into a newly created “Account 3,” which allows real-time access for emergencies. However, this comes at the cost of reduced savings in your long-term retirement accounts.

2. Withdrawal Impact Forecasting Tool

Before confirming a withdrawal, the system shows you a simulation of how the transaction will affect your retirement fund at age 55 or 60. This encourages better decisions and discourages impulsive withdrawals.

3. Staggered Withdrawal Mechanism

Large withdrawals are now split into stages. For instance, if you need RM30,000 for a house, the system will release it in phases to help you manage the money more responsibly.

Financial Experts Weigh In: Now Is the Time to Be Extra Cautious

According to certified financial planner Dato’ Lim Kee Yaw, “Withdrawals must evolve from ‘I need, I take’ into ‘I’ve planned, now I proceed.’”

He refers to 2024 data showing that over 68% of EPF members had less than RM50,000 in their account by age 55—a figure that puts them at risk of elderly poverty.

He recommends a three-step method before withdrawing:

- Step 1: Evaluate – Is this truly a financial emergency?

- Step 2: Simulate – Will this affect your future lifestyle?

- Step 3: Consider Alternatives – Could savings, loans, or government aid solve the issue instead?

Retirement Planning in 2025: You Fail to Plan, You Plan to Struggle

EPF was never meant to be your monthly spending account—it’s your future. While the 2025 policy offers more freedom, it also demands smarter choices.

Frequent withdrawals during your 30s or 40s can drain your nest egg and leave you scrambling during retirement.

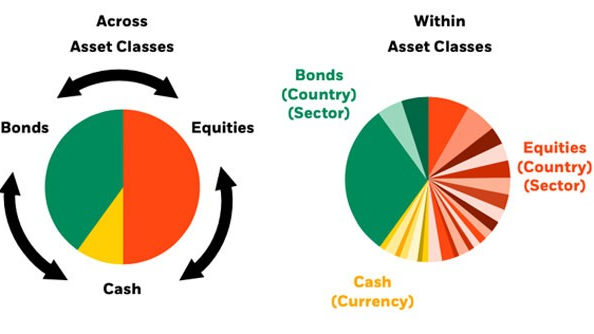

Here’s how experts suggest you manage your EPF accounts:

- Save more while you’re young; resist the temptation to dip into EPF

- Treat Account 1 as untouchable; use Accounts 2 and 3 strategically

- Review your retirement plan every five years and make adjustments accordingly

Final Word: You’re Not Just Withdrawing Cash—You’re Withdrawing from Your Future

The new EPF withdrawal system isn’t just a feature; it’s a financial crossroad. While it can help you realize dreams or survive hardship, it must be approached with knowledge, preparation, and restraint.

2025 is not the year to “withdraw and worry later.” It’s the year to withdraw responsibly—or not at all.

Your EPF account is your future lifeline. Don’t spend tomorrow’s security solving today’s problems.

Outbound Link:

【Policy Shake-Up】Malaysia’s EPF System Enters a New Era—What You Must Know